Notes from Saudi '25

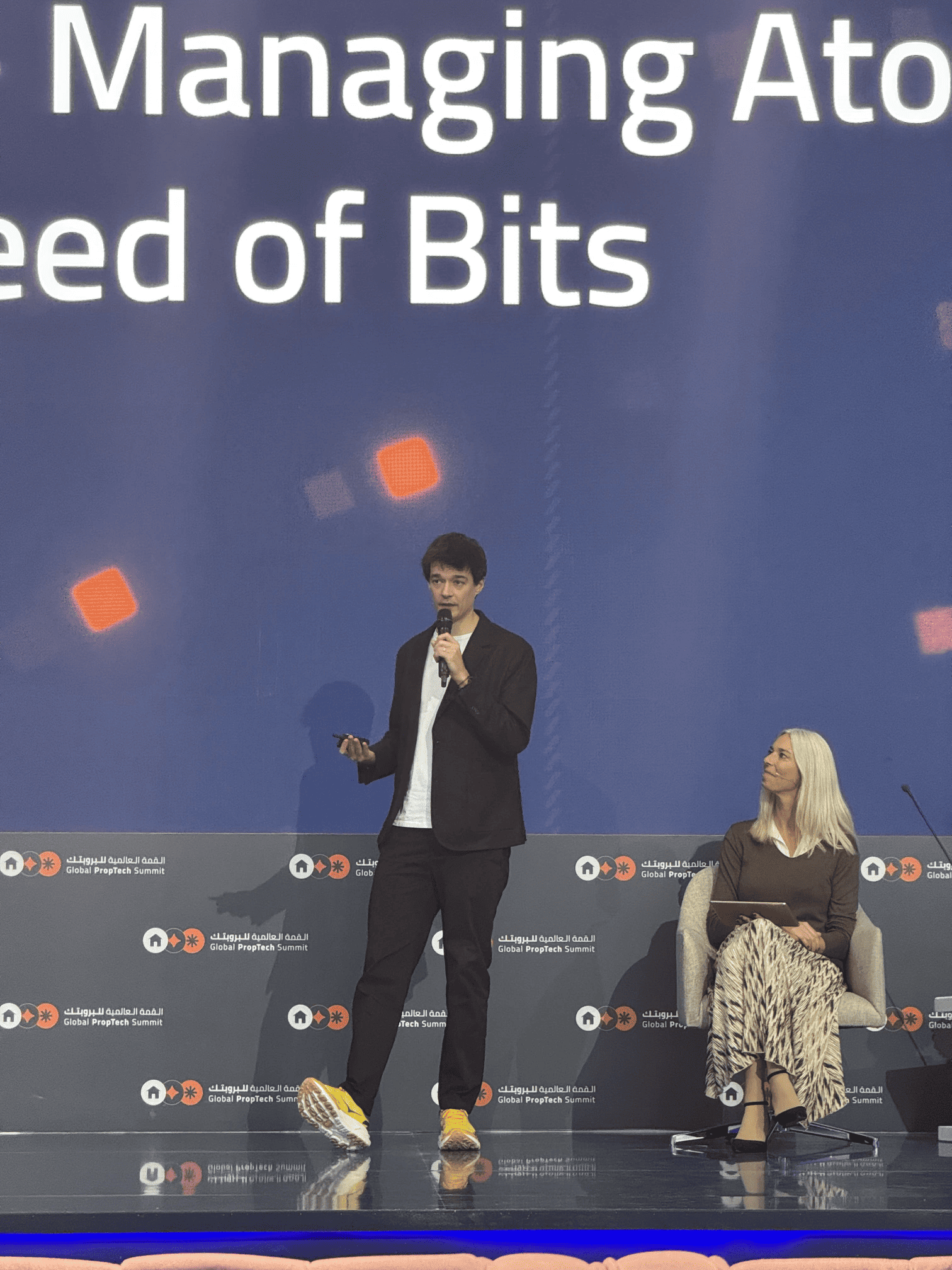

Last month, I had the privilege of speaking at the Global Proptech Summit in Riyadh, Saudi Arabia. Standing in front of industry leaders in a city that’s literally building its future from scratch, I presented on how data and AI are unlocking the next generation of commercial real estate. What struck me most wasn’t just the scale of ambition – with office space in Riyadh projected to nearly double from 5.5 million to 9.8 million square meters by 2027 – but the speed at which they’re moving. In Europe, we schedule business meetings 3-6 months out. There, it’s next week. In Europe, I spend time convincing real estate companies to invest in technology. There, it’s the starting point.

This experience crystallized something I’ve been observing for years: the commercial real estate industry globally stands at a crossroads, and the gap between those who adapt and those who don’t is widening fast.

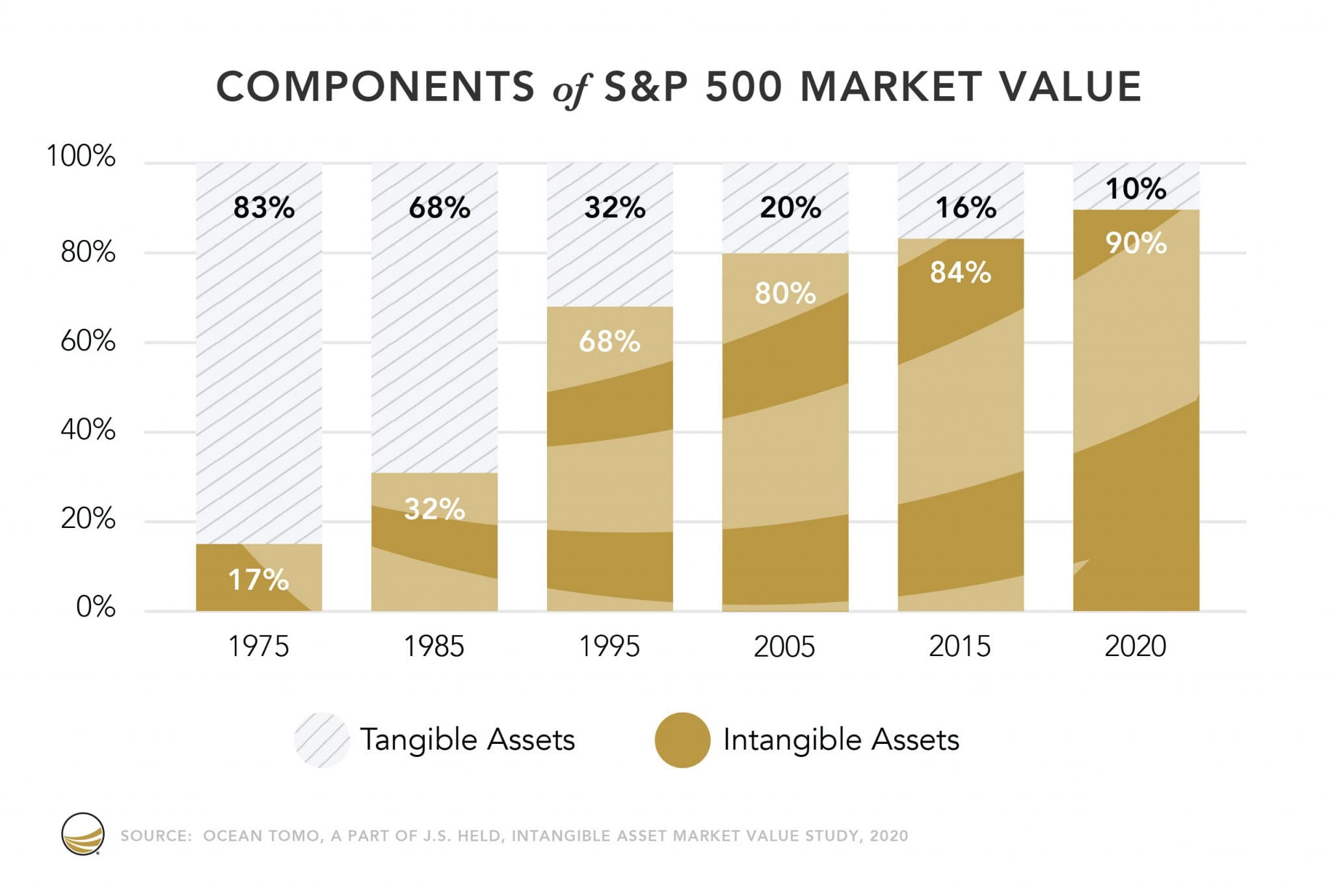

Over the past decade, operating margins for real estate companies in the S&P 500 have fallen from around 25% to 15% – nearly 40% erosion in value (source 1, source 2). During the same period, tech companies maintained their margins with an upward trend. This isn’t coincidence – it’s a symptom of a fundamental shift in the economics of value.

Over the past fifty years, the structure of economic value has undergone a revolution. In 1975, over 80% of the value of the world’s largest corporations consisted of physical assets – factories, warehouses, buildings. Today, the proportions have completely reversed: 90% of value is intangible assets (source - Ocean Tomo). Nvidia, a company that designs chips but owns not a single factory, has achieved a valuation exceeding the GDP of the United Kingdom or France. Competitive advantage has shifted from mass to scalability, from ownership to adaptation.

Commercial real estate doesn’t have a technology problem – it has a physics problem. You can’t pivot a building weighing 150,000 tons of concrete and steel like a line of code. Take the office space crisis, commonly associated with the pandemic – it has much deeper roots. COVID-19 was just the spark – the explosive material had been lying in the industry for years. Technologies enabling remote work were ready long before 2020. Companies switched to home office in weeks because the software was available. Buildings couldn’t pivot at all. In 2024, Goldman Sachs analyzed the issue of office building conversions in the US and concluded that prices would have to drop by 50% for conversion to make economic sense (source).

The industry’s fundamental problem is scattered data. Every advisory firm, every fund, every developer duplicates the effort of collecting the same market information. Analysts spend most of their time not analyzing, but copying data between spreadsheets.

This isn’t just inefficient – it blocks transformation. You can’t scale a business with technology using scattered data. Today, scaling is synonymous with artificial intelligence, and AI doesn’t work without unified, digital data. Without it, AI remains a buzzword.

Industry data shows the scale of this challenge: 45% of sector leaders identify talent acquisition as one of the key challenges (ULI Emerging Trends in Real Estate 2025). The younger generation can’t imagine working without AI tools, real-time data, and systems that automate routine tasks. Companies that don’t offer this are losing the battle for workers to more technologically advanced sectors.

According to JLL, over 90% of companies in the industry plan to implement AI, with two-thirds already running pilots. In 2024, global investments in AI solutions for real estate reached $3.2 billion (source). This isn’t an experiment – it’s the new reality.

The answer to the problem of fragmentation is transparency. Not as an ethical declaration, but as infrastructure. Platforms aggregating data on thousands of buildings eliminate the duplication of data collection costs. Integrations with advisory firm systems cut analysis preparation time by 80%. Automation frees analysts from copy-paste, allowing them to focus on what requires human thinking.

Transparency as Infrastructure

My company REDD, aggregating data on over 6,000 office and warehouse properties in CEE, is the exclusive data provider for the Poland’s Statistics and Eurostat. The same data serves advisory firms – from CBRE, Savills, and BNP Paribas Real Estate to investment funds such as Invesco, Griffin Capital Partners, Logicor, and Prologis.

Transparency changes the rules of the game. In a transparent model, competition isn’t about who knows what. It’s about who employs the best people and who has better tools. Information asymmetry gives way to operational advantage.

The industry faces a choice: accelerate or evaporate. The tools exist, the technology works, and implementation costs are falling. Every day of delay widens the gap. Everyone is becoming a technology company. The question is, who will be writing the code?